Understanding Vietnam Crypto Trading Patterns: Insights and Strategies

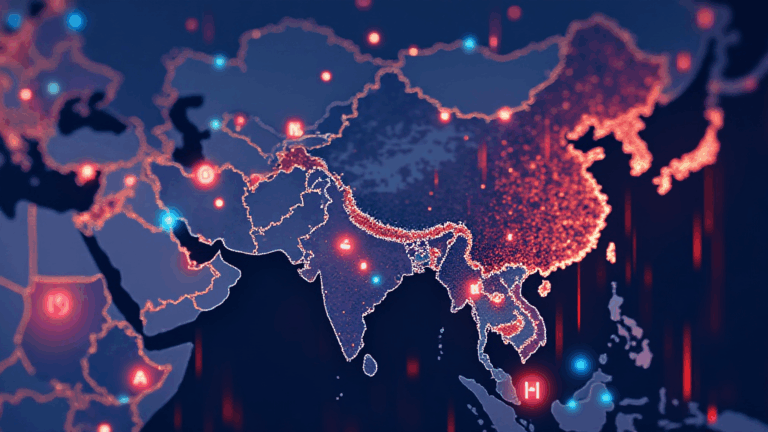

As the digital landscape evolves, Vietnam has emerged as a significant player in the cryptocurrency market, showing a fascinating array of

Why Focus on Vietnam?

With a population exceeding 98 million, Vietnam presents a unique market for cryptocurrency. The

Understanding the Market Dynamics

ong>Regulatory Environment: ong> The government’s stance on cryptocurrencies continues to evolve. New regulations around tiêu chuẩn an ninh blockchain are shaping the way traders interact with the market.ong>Investor Demographics: ong> The majority of Vietnamese crypto investors are aged between 18 and 35, indicating a youthful yet educated market.ong>Trend Shift: ong> From traditional investments to digital assets, there’s a palpable shift attracting investors to platforms that offer innovative trading features.

Common Trading Patterns in Vietnam

Identifying the common trading patterns specific to Vietnam can provide profound insights for investors. Here are a few key observations:

1. Peer-to-Peer (P2P) Trading

P2P trading has gained popularity among Vietnamese investors due to its privacy and lower fees. Unlike centralized exchanges, P2P allows users to trade directly with each other. This trend is particularly appealing in a market where users prioritize control over their assets.

2. High Volatility Trading

Vietnam’s crypto market exhibits high volatility, attracting traders who seek short-term gains. This speculative trading behavior results in rapid price fluctuations, providing profitable opportunities for experienced traders or newcomers willing to take risks.

3. Interest in Altcoins

Many Vietnamese traders are diversifying their portfolios by investing in altcoins, particularly emerging tokens. Research shows that altcoins like Ethereum and Cardano saw significant adoption in 2024 as users look for projects behind promising technology.

Effective Strategies for Trading in Vietnam

To navigate the complex landscape of

1. Do Your Research

Whether using platforms like hibt.com or exploring local blockchain projects, it’s crucial to stay informed. Understanding the underlying technology and potential market shifts can significantly influence trading decisions.

2. Leverage Analytical Tools

Utilizing crypto-specific analytical tools can help traders monitor market movements and make informed decisions. Tools such as TradingView provide real-time data and insights.

3. Risk Management

Establishing clear risk management protocols is vital. Setting stop-loss orders can protect investments in times of high volatility. Remember, investing in crypto carries risks—appropriate strategies can mitigate these.

Future Trends and Predictions for 2025

Looking ahead, several trends are likely to shape the future of crypto trading in Vietnam:

1. Increased Regulatory Clarity

Expect clearer frameworks to emerge around crypto regulations, allowing for safer trading and enhanced investor confidence.

2. Growing Institutional Interest

As the crypto market matures, more institutional investors are expected to enter, leading to potentially significant liquidity shifts.

3. Integration of Advanced Technologies

Technologies such as artificial intelligence and machine learning will likely play a role in enhancing trading strategies, making it easier for traders to analyze market data effectively.

Conclusion

Vietnam shows promising potential in shaping future

For further exploration into the world of cryptocurrency, consider platforms like coinmachinvestment for comprehensive insights and resources.