Understanding Impermanent Loss in DeFi: A Strategic Guide

As decentralized finance (DeFi) continues to evolve, investors are drawn to the potential for high returns through liquidity provision. However, with opportunities come risks. One of the most significant risks is impermanent loss, which has become a hot topic among DeFi participants. In 2024 alone, DeFi hacks and exploitations resulted in losses exceeding $4.1 billion, highlighting the importance of understanding these risks when participating in this space.

This guide aims to demystify impermanent loss, helping you navigate its complexities while leveraging DeFi platforms effectively. So, what exactly is impermanent loss, and how can you strategize around it?

What is Impermanent Loss?

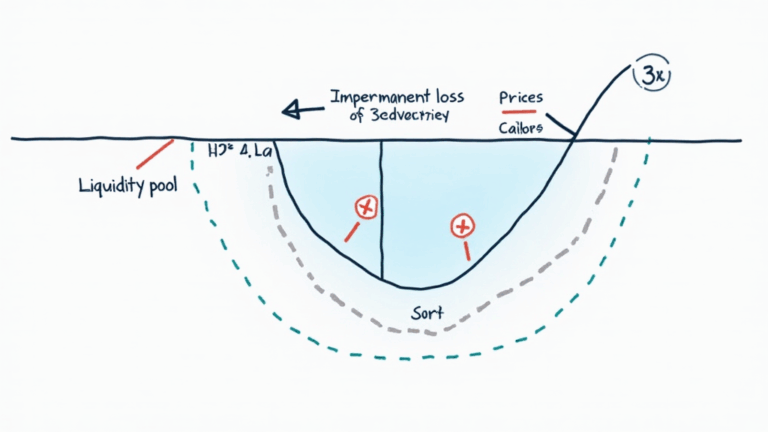

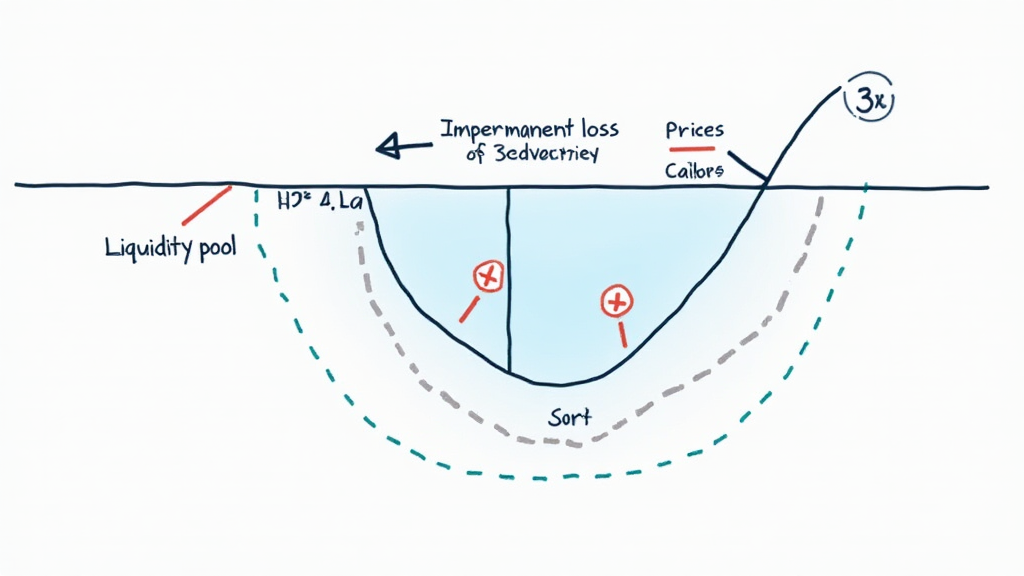

Before diving deep into strategies to mitigate impermanent loss, let’s clarify what it entails. Impermanent loss occurs when you provide liquidity to a decentralized exchange (DEX) and the prices of the assets you deposited diverge significantly from their prices at the time of deposit. In essence, if you lock up assets in a liquidity pool, you could end up with less value compared to if you simply held the assets in your wallet.

Here’s the catch: impermanent loss is called ‘impermanent’ because it only crystallizes when you withdraw assets from the liquidity pool. If the price divergence corrects itself, you may not suffer any loss at all. To illustrate:

ong>Liquidity Pool Scenario: ong> You provide $1,000 worth of ETH and $1,000 worth of DAI to a pool.ong>Price Movement: ong> The price of ETH doubles, reducing your relative holdings of ETH in the pool.ong>Withdrawal: ong> You withdraw your assets and find that the value of your holdings is less than if you had maintained them separately.

Example of Impermanent Loss

Let’s break it down further using a scenario in a DEX like Uniswap:

- You deposit 1 ETH (worth $2,000) and provide an equivalent in a stablecoin (e.g., DAI, also worth $2,000).

- The price of ETH rises to $4,000, which alters the pool’s asset ratios.

- Upon withdrawal, instead of 1 ETH and $2,000 in DAI, you receive approximately 0.7 ETH and $2,800 in DAI.

- This results in a net loss compared to simply holding onto the assets separately—a classic example of impermanent loss.

Calculating Impermanent Loss

Understanding how to calculate impermanent loss can help investors gauge their risk and return profile better. The formula for calculating impermanent loss when the prices of assets diverge is as follows:

Where:

ong>P1: ong> The price of the asset at the time of deposit.ong>P2: ong> The price of the asset at the time of withdrawal.

Using this simple formula, you can input different price scenarios to understand potential risks and returns.

Strategies to Minimize Impermanent Loss

Given the unpredictability of market conditions, it’s essential to adopt strategies that help mitigate impermanent loss effectively. Here are some actionable strategies to consider:

ong>Select Stablecoin Pairs: ong> Providing liquidity in pools that consist of stablecoin pairs typically results in lower impermanent loss, as stablecoins usually maintain a consistent value.ong>Utilize Volatility: ong> Rather than providing liquidity for highly volatile assets, focus on pairs with stable price movements. Strategies such as liquidity mining can also enhance your returns.ong>Diversify Liquidity Pools: ong> Using multiple liquidity pools can reduce the risk associated with impermanent loss. Explore pools from various DeFi projects to spread out your exposure.ong>Dynamic Strategies: ong> Some platforms utilize algorithms to adjust liquidity positions based on market conditions, reducing potential losses.

The Impact of Impermanent Loss on DeFi Investments in Vietnam

As the DeFi ecosystem matures, local markets, such as Vietnam, are witnessing a rise in DeFi adoption. According to recent statistics, Vietnam has seen a 120% growth rate in DeFi participation among crypto users in 2024. This local surge underlines the importance of understanding the risks, including impermanent loss, that DeFi investors face.

As Vietnamese users become more aware of impermanent loss, platforms like hibt.com are providing educational resources to equip investors with strategies to safeguard their assets.

Conclusion

In conclusion, impermanent loss is a crucial factor for anyone participating in DeFi, especially in fast-growing markets such as Vietnam. By taking proactive measures and understanding the underlying mechanics, investors can significantly reduce the impact of impermanent loss on their portfolios.

As you dive deeper into the world of DeFi, remember that while high returns are tempting, managing risks effectively is equally vital. Keeping abreast of industry trends with reputable sources such as hibt.com and engaging with community discussions will enhance your strategies in navigating this ever-evolving landscape.

For more insights on blockchain technologies, including topics like