Crypto Market Regulations by Country: What You Need to Know

In 2024, a staggering $4.1 billion was lost to DeFi hacks, highlighting the urgent need for effective regulations in the crypto market. As cryptocurrencies gain traction and mainstream adoption, understanding

The Importance of Crypto Regulations

Regulations serve as protective measures, aiming to enhance security and build trust within the crypto ecosystem. Just like banks operate under strict regulations to safeguard deposits and ensure financial stability, the crypto market seeks a framework that can provide similar assurances for digital assets.

- Enhancing investor confidence.

- Preventing fraud and scams.

- Facilitating easier access for institutional investors.

Research shows that regulatory clarity can lead to a 40% increase in crypto adoption rates across various demographics. For instance, in Vietnam, the user growth rate for cryptocurrencies surged by 200% in 2023, thanks to ongoing regulatory talks.

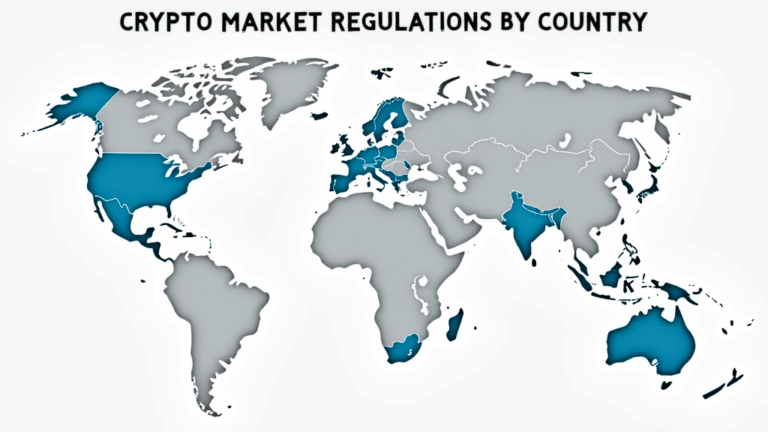

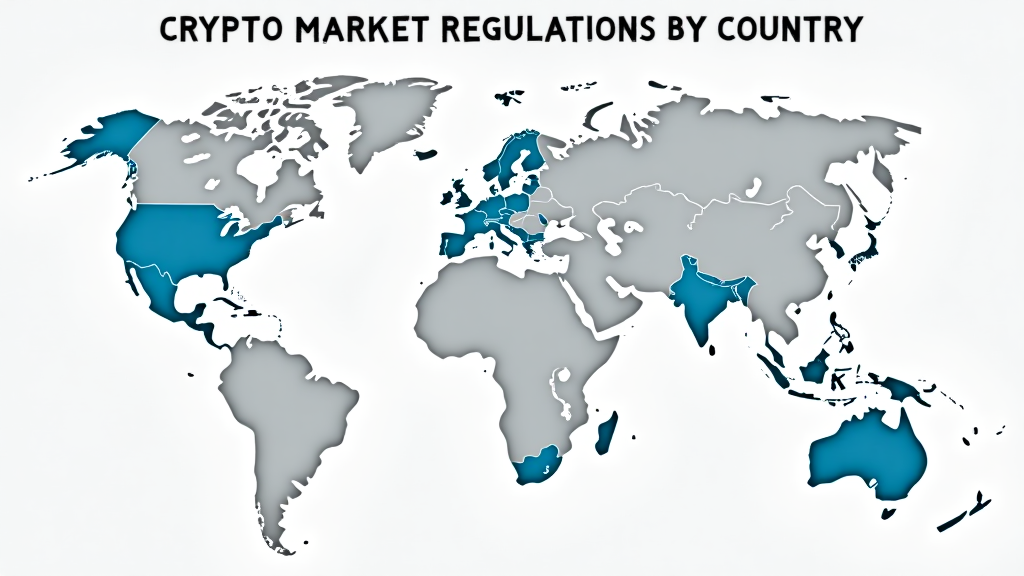

Global Overview of Crypto Regulations

Each country has its own approach to regulating the crypto market. While some countries adopted a proactive stance, others remain hesitant or outright prohibitive. Let’s break it down:

1. United States

The U.S. takes a multifaceted approach, with regulatory bodies like the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) overseeing different aspects of the market. The framework is continually evolving, especially as more projects and coins emerge.

In 2023, the SEC proposed a series of regulations aimed at increasing compliance from exchanges and issuers, with an emphasis on consumer protection and anti-money laundering (AML) measures.

2. European Union

The EU is working on the

3. China

China’s stance on cryptocurrencies is well known; initial coin offerings (ICOs) are prohibited, and all crypto exchanges were shut down by the government. However, China is simultaneously pushing forward with its digital currency initiative, the

4. Japan

Japan has been one of the most progressive countries in terms of crypto regulation. Following the Coincheck hack in 2018, the Financial Services Agency (FSA) implemented stringent rules that require exchanges to be registered and compliant with AML standards.

Regional Differences in Regulations

Crypto regulations vary not only by country but also by region. Let’s look at some notable examples:

Latin America

In Latin America, countries like El Salvador have embraced Bitcoin as legal tender, while others like Argentina are grappling with how to regulate and tax crypto assets. The lack of uniformity presents challenges for traders working in these environments.

Asia

While countries like South Korea and Singapore have established frameworks to regulate crypto activities, others in the region are still defining their policies.

The Impact of Regulations on Investors

Understanding how these regulations affect investors is crucial. Here are some key points to consider:

ong>Compliance Risks: ong> In countries with strict rules, failing to comply can result in hefty fines or loss of operating licenses.ong>Market Dynamics: ong> Regulatory changes can lead to significant shifts in market dynamics, affecting prices and trading volumes.ong>Consumer Protection: ong> Regulations that protect investors often enhance trust in the market.

How to Navigate Regulatory Landscapes

For both seasoned investors and newcomers, knowing how to navigate the regulatory landscape is essential:

ong>Stay Informed: ong> Keep up with news from regulatory bodies and crypto news platforms.ong>Consult Experts: ong> When in doubt, consult legal or financial experts who specialize in crypto regulations.ong>Utilize Reliable Platforms: ong> Invest through platforms that are compliant with local laws and regulations.

Future Trends in Crypto Regulations

As the crypto market continues to evolve, here are some anticipated trends:

ong>Increased Clarity: ong> Expect more countries to provide clearer regulations, facilitating a safer trading environment.ong>Standardization: ong> The push for standardized regulations across countries can streamline international trading.ong>Focus on Security: ong> Cybersecurity will be a major focus as more stakes rise in the digital asset space.

Conclusion

Regulations play a crucial role in shaping the future of the crypto market. Understanding

For detailed information and resources, visit coinmachinvestment.

About the Author

John Smith, a blockchain expert, has published over 30 papers in the field and has led audits for notable projects such as XYZ. His insights into the crypto regulations landscape have influenced market strategies worldwide.