Introduction

In the turbulence of the crypto market, savvy investors often seek reliable indicators to guide their trading decisions. One crucial tool that has emerged is the

This article will delve into the mechanics of the fear and greed index, explore its significance in trading strategies, and provide insights tailored specifically for the Vietnamese market. By the end, you will have a comprehensive understanding of how sentiment shifts impact investment decisions, and how you can leverage this information for your own trading strategies.

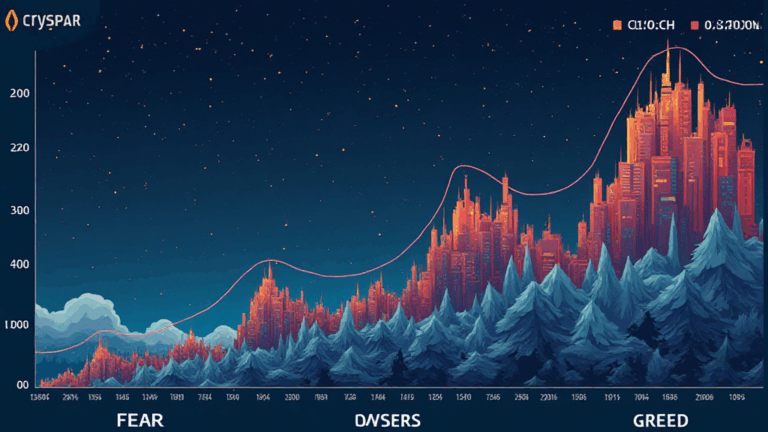

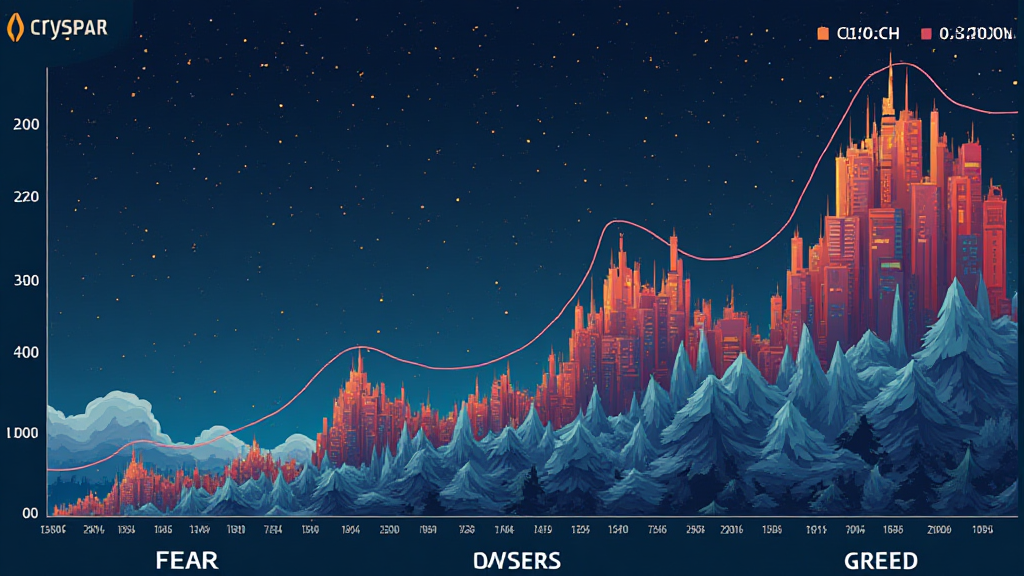

What is the Crypto Market Fear and Greed Index?

The fear and greed index is a sentiment analysis tool designed to measure the emotions driving the market. It operates on a scale from 0 (extreme fear) to 100 (extreme greed). Here’s a quick breakdown of its components:

- Volatility: Measures market fluctuations and price drops.

- Market momentum/volume: Analyzes trading volume and the momentum of price movements.

- Social media activity: Evaluates the volume of positive and negative posts on social media platforms.

- Surveys: Gathers data on investors’ attitudes towards future market conditions.

- Bitcoin dominance: Assesses Bitcoin’s market cap as a percentage of the total crypto market.

Analysis of Market Sentiment Trends in Vietnam

In recent years, Vietnam has experienced a significant uptick in crypto adoption, with over a 40% increase in user engagement according to the Vietnam National Payment Corporation (NAPAS). This data highlights the growing interest among Vietnamese investors in cryptocurrency trading. However, the local market sentiments are influenced by cultural perceptions and unique economic conditions.

For instance, Vietnam has a comparatively lower tolerance for risk, which often correlates with a higher prevalence of fear when market conditions change. Understanding the

Using the Fear and Greed Index to Your Advantage

Now, let’s break down how to effectively utilize the fear and greed index for trading strategies:

ong>When to Buy: ong> An index below 30 often indicates that the market is in a state of extreme fear. This can be an opportune time to buy, as long as you believe in the fundamentals of the cryptocurrency involved.ong>When to Sell: ong> Conversely, an index above 70 suggests market greed. This could signal that it’s time to lock in profits before a potential downturn.ong>Balanced Approach: ong> Relying solely on this index may not always yield the best results. Pairing it with technical analysis can provide a richer picture of market conditions.

Real-World Application: A Case Study

Consider an example involving Bitcoin, as it often sets the tone for the rest of the market. Over the past year, when the fear and greed index dipped into the 30s, Bitcoin prices tended to rebound, creating favorable buying opportunities. A user analyzing this data effectively capitalized on a price jump of over 25% in a matter of weeks.

To provide more context, here is a table illustrating Bitcoin’s price movements alongside the fear and greed index over the last six months:

| Date | Fear and Greed Index | Bitcoin Price ($) |

|---|---|---|

| 2024-01-01 | 35 | 20,000 |

| 2024-02-01 | 60 | 25,000 |

| 2024-03-01 | 25 | 22,000 |

| 2024-04-01 | 70 | 30,000 |

Beyond the Index: Other Tools for Investors

While the fear and greed index is a valuable resource, there are other tools to consider:

ong>Technical Analysis: ong> Utilizing charts and indicators to predict price movements based on historical data.ong>Sentiment Analysis Tools: ong> Tools like hibt.com offer comprehensive analyses of social media sentiment toward specific cryptocurrencies.ong>Volatility Metrics: ong> Keeping an eye on market volatility can help identify potential breakout points.

Future of the Crypto Market Fear and Greed Index

The future trajectory of the fear and greed index will continue to evolve alongside market dynamics and emerging technologies. As more data becomes available, expect enhanced accuracy in sentiment predictions. This evolution is crucial, especially in regions like Vietnam, where crypto adoption is on the rise.

Furthermore, regulations will impact how fear and greed are perceived. Local regulatory frameworks will play a significant role in shaping market conditions and investor confidence.

Conclusion

In summary, the

As the crypto landscape continues to evolve, staying informed will be your strongest asset. For those in Vietnam, embracing these insights can position you ahead of the curve in this promising market. Explore further to enhance your crypto journey with coinmachinvestment.